The Basics of Fix & Flip Loans

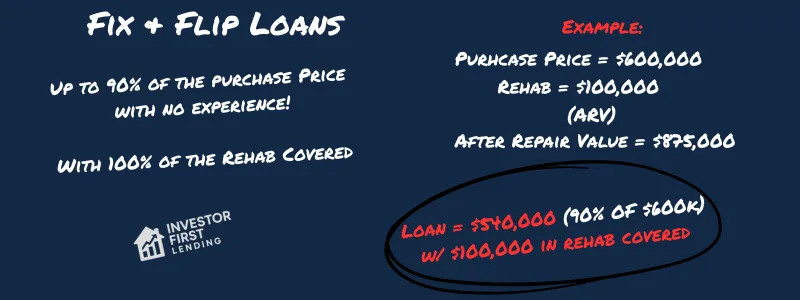

With a fix & flip loan you can get a loan for up to 90% of the purchase price with 100% of the rehab costs covered.

This means if you were buying a property for $200,000 that needed $50,000 of work and the ARV (after-repair-value) was $350,000 you could potentially get a loan for $180,000 to buy the property (90% of the $200k purchase price) and the rehab ($50,000) would be covered as part of the loan.

It's important to note that rehab ($50,000 in this example) is done on a draw basis.

This means when you close on the property you'll need some money to start rehab.

Once you do some work (example $10,000) the lender will confirm the work is done and then they'll wire you the $10,000 (minus an inspection fee, which is usually around $199).

Terms on fix & flip loans range from 6 to 24 months.

The Disadvantage of Fix & Flip Loans

They're not cheap.

Fix & flip loans typically include 2-4 points (a point is 1% of the loan amount) and interest rates are usually between 9 and 13%.

The Advantages of Fix & Flip Loans

You can acquire a property with as little as 10% of your own money (+ closing costs) with 100% of the rehab covered.

You can acquire a property that would not qualify for conventional financing.

It is not a "full doc" loan meaning you do not need to provide your personal income or employment information to qualify.

While the interest rate and points are higher than you'd pay on a traditional 30 year fixed loan keep in mind that you'll only have the loan for a very short period of time. For example, if you buy a property that you rehab and finance (or sell) in 60 days you may only make 1 or 2 payments on the loan.

We've seen countless examples of investors exhausting their funds to buy a property in cash and then using credit cards to finance the rehab. In mosts cases the credit cards get maxed out and their credit scores drops significantly. If the goal is keep the property after the rehab is done it becomes very difficult to do because of the drop in their credit score.

Because you can acquire a property with as little as 10% down this allows you to keep additional funds if you run across another great property before you finish rehabbing the current one.

Fix & flip loans are an excellent tool if you factor in the closing costs and monthly payments in your overall analysis and the deal still makes sense.

Key Features of Fix & Flip Loans

No Personal Income or Employment Verification

Loan Amounts Starting At $75k

1-4 Units

5+ Units

Mixed Use

Commercial

Credit Scores Down To 500

First Time Investors Ok